do tax assessors use zillow

442-H New York Standard Operating Procedures New York Fair Housing Notice TREC. Real Estate Portal USA LLC.

Use Bad Pricing Estimates By Zillow And Redfin To Your Advantage

According to Zillow the nationwide.

. 253 Hampshire Ct Piscataway NJ is a condo home that contains 1138 sq ft and was built in 1986. Educate the public about the property tax system. 455 Hoes Lane Piscataway NJ 08854.

The appraisal provider for the county would most likely be the one to question regarding the validity of the assessment and not Zillow if Zillow value or property data is scrutinized before an independant appraisal is conducted by the contracted appraisal for the. They use actual tax records for sales. After some research the couple concludes that based on recent sales of comparable homes the taxable value of their home should be 350000.

NJ tax assessors arent dumb enough to use Zillow as a tool because Zillow is inaccurate garbage. Louis County MO assessors dont use Zillow. The property assessors goal is to try and extract as much money from homeowners as possible.

More than 400 million detailed public records across 2750 US. Are their suppositions good and accurate. For example a homeowner may contact Zillow to update information about their propertys features.

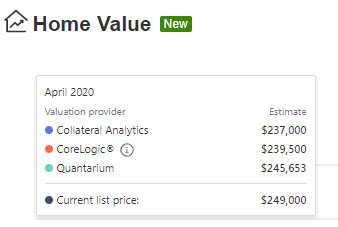

Your property tax assessment is determined on a certain date. Use our free New York property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. A huge component in Zillows formula is assessed the home value or the value placed on a property for tax purposes which is usually only around 20 of the fair market value of the home.

We have to file a certificate of value when a sale closes and they use actual data. There are two main columns Property Taxes and Tax Assessment. Similarly what is a tax assessment on Zillow.

It contains 2 bedrooms and 2 bathrooms. Youll be prompted to confirm that you want to extend your listing for 90 days. Zillows unique algorithms update its collection of property values multiple times a week based on information from both public data and user-submitted data.

The 2 are very differeI was trying to analyze a property in Fort Worth TexasI looked up the taxes on Zillow as well as on the county assessor site. NJ tax assessors arent dumb enough to use Zillow as a tool because Zillow is inaccurate garbage. The Assessed Value of a real estate property is the value assigned to a property to determine applicable taxes.

Ad See If You Qualify For IRS Fresh Start Program. Assessed valuation determines the values of a home for tax purposes and it takes into cognizance inspections and home sales. The Zestimate of value as they like to call it can be off by tens of thousands of dollars or more.

Assessors are appointed individually and must fulfill the requirements for State certification pursuant to NJSA. THE ASSESSING OFFICE IS OPEN MONDAY - FRIDAY BETWEEN 830 AM 430 PM Office Closed Between 1220 PM - 130 PM For Lunch CONTACT INFORMATION. If you have a home that has a market value of 150000 your home will be assessed at 150000.

So if say the market value of your home is 200000 and your local assessment tax rate is 80 then the taxable value of your home. This flawed formula can lead to an inaccurate Zestimate of tens of thousands of dollars and in some cases hundreds of thousands. While tax assessors real estate agents appraisers and automated home value estimators are all available options each has a different role and will likely have a different idea of what your home.

Holds real estate brokerage licenses in multiple provinces. 1434 W 5th St Piscataway NJ 08854-1840 is a single-family home listed for-sale at 479900. Free Case Review Begin Online.

Zillow acquires data from tax assessor and county records real estate brokerages and multiple listing services MLS. Your property tax bill is based on the assessed value of your property any exemptions for which you qualify and a property tax rate. This is the price the government tax assessor estimates the property would sell for on the open market as of the effective date for the assessed value for the year in question.

Click on your profile icon in the top right corner. The estimator considers all of that information and uses it. The Zestimate for this house is 328900 which has increased by 328900 in the last 30 days.

A list of our real estate licenses is available here. They use actual tax records for sales. I dont think it would be relevant Jo if the assessor uses an independant appraisal method and a provider for that matter.

Property characteristics geographic information and prior valuations for approximately 150 million parcels in. The local tax rate is 10 for every 1000 of taxable value. More than 20 years of deed transfers mortgages foreclosures auctions property tax delinquencies and more for both commercial and residential properties.

Like other similar tools Redfin and Zillow calculate a homes estimated value using publicly available data like tax records recent property sales and local market trends. This makes their annual property tax 4000. In some cases.

However if your taxing authority assesses homes at 70 percent of value your 150000 market value home will have a tax assessed value of 105000. Look for the More button and from the dropdown menu select Extend listing. But you savor misleading info and flat out false info so you should be a big zesty fan.

It also incorporates user-submitted data. Louis county mo assessors dont use zillow. However real estate agents do not use Zillow to price a home.

The 2 are very differe. To provide a fair and equitable assessment for each property. The assessors market assessed value is based on actual historical sales of similar properties for a specified study period.

The Rent Zestimate for this home is 2070mo which has increased by 163mo in the last 30. Using these values you can divide the number from your property tax bill by the tax rate to get the assessed value of your home. View more property details sales history and Zestimate data on Zillow.

Zestimate Home Value. I was trying to analyze a property in Fort Worth TexasI looked up the taxes on Zillow as well as on the county assessor site. Louis County MO assessors dont use Zillow.

Generally the assessed value of a home tends to be lower than the appraised fair market value of a property. Home is a 3 bed 20 bath property. For example suppose where you live homes are assessed at 100 percent of market value.

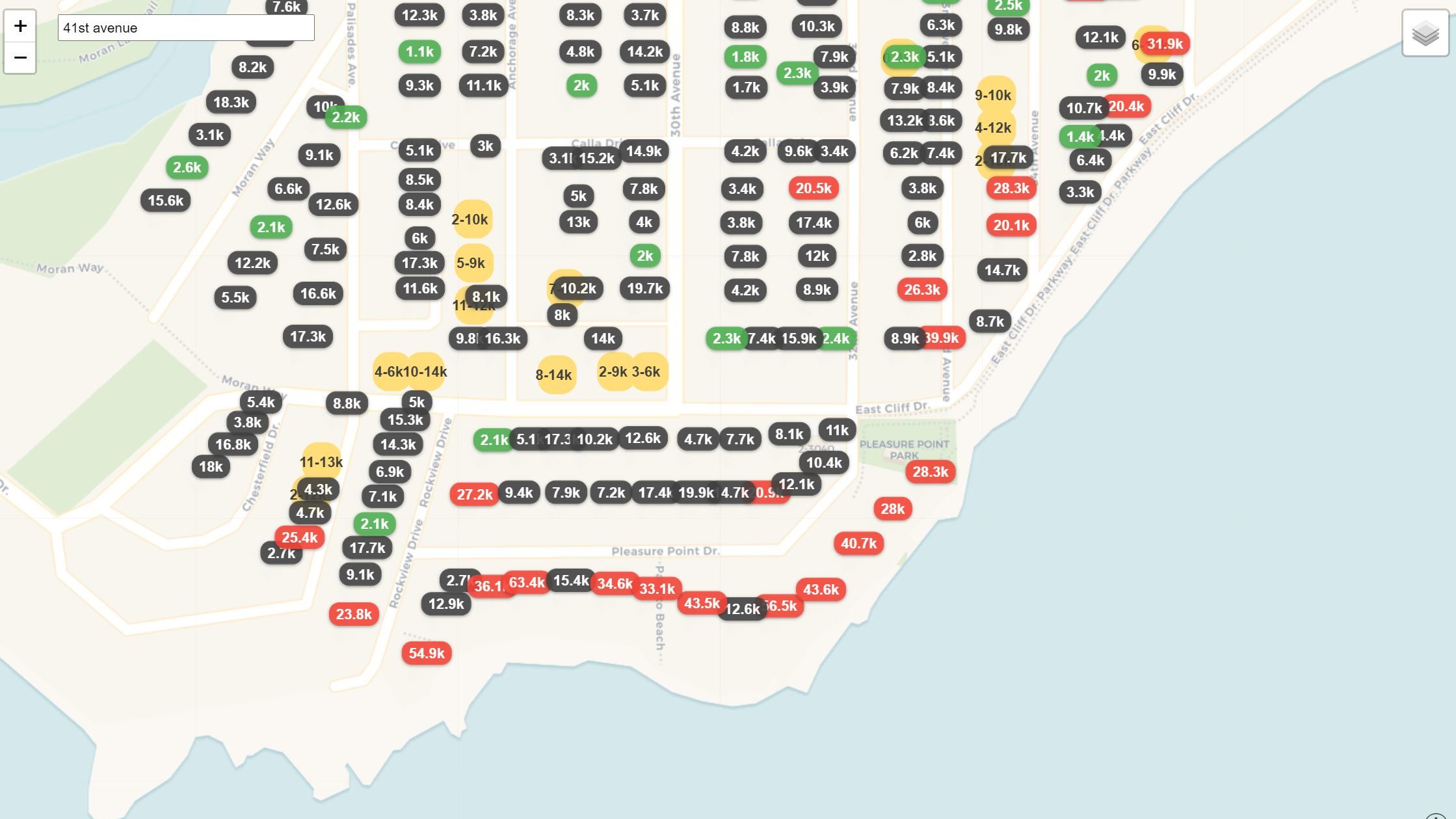

Assessed values are used by towns to collect taxes and in many cases trail the actual market value of a home. Are their suppositions good and accurate. I checked the house on the countys page and the Zillow number was not exactly the same but basically the sameI am just.

Click on Your Home from the dropdown menu. Information about brokerage services Consumer protection notice California DRE 1522444Contact Zillow Inc. Qualifications of the Assessor.

Up to 25 cash back The tax assessor has given it a taxable value of 400000. We Help Taxpayers Get Relief From IRS Back Taxes. Considering my assessment and zestimate were more than 100k apart I think its safe to say theyre not using it.

Exploit Online Data To Lower Your Property Taxes

Use Bad Pricing Estimates By Zillow And Redfin To Your Advantage

How To Use Zillow For Your Next House Hunt Home

Does Your County Assessor Have A Zillow Profile

Cook County Used Zillow S Zestimate Tool In Official Assessments Really Chicago Agent Magazine

Exploit Online Data To Lower Your Property Taxes

Zestimate V The Assessment Property Estimate From Zillow Com Was Not Probative Evidence Of A Home S Value According To The Indiana Board Of Tax Review Tax Hatchet

Are Zillow Zestimates Accurate Truth On Real Estate Estimates

Zestimate V The Assessment Property Estimate From Zillow Com Was Not Probative Evidence Of A Home S Value According To The Indiana Board Of Tax Review Tax Hatchet

Augusta Metro Area Property Taxes Below U S Average But Richmond County Is Right On The Line

Maps Show Disparity In Santa Cruz County Property Taxes Santa Cruz Local

Soaring Home Values Mean Higher Property Taxes

Are Zillow Zestimates Accurate Truth On Real Estate Estimates

/x_reasons_zillow_estimates_are_not_as_accurate_as_you_think-5bfc3429c9e77c002631fd3e.jpg)

Zillow Estimates Not As Accurate As You Think

Neighbors Selling Homes At A Great Price Could Cost You More 13wmaz Com

How Reliable Are Zillow S Real Estate Value Estimates Quora

Using Zillow To Efficiently Value A Client S Residence